Bebo Sells for $10 Million (or Less) – AOL Only Loses $840 Million of the Original Purchase Price

Talk about a good deal. Or a bad one, depending on which side of the coin you’d like to take.

Criterion Capital Partners are now the proud owners of one slightly used social network – Bebo. In 2008, AOL paid $850 million to acquire the network, once the number one social network for teens and young adults in the UK.

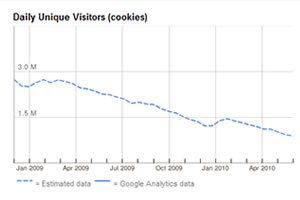

Somewhere between then and now, Bebo’s growth stalled as Facebook snapped up the #1 position in the UK and displaced the network. Bebo was in good company – in the US MySpace has shuffled the executive chairs numerous times to try to reclaim some of their former market glory. While Bebo still attracts a very healthy 12 million visitors a month, according to Google AdPlanner, there’s also a very noticeable downward trend from January of this year.

Source: Google Ad Planner

Bebo may not be entirely at fault for that. After a half-hearted attempt to integrate Bebo with AIM (AOL’s Instant Message product), the company broke with TimeWarner, got a new CEO and decided that Bebo didn’t fit with the direction they were taking going forward.

Existing Bebo users didn’t respond well to the changes, and while that may not have been the entire reason, it didn’t do anything to stave off competition from Facebook.

For what’s speculated to be tax reasons – it’s cheaper for AOL to sell the company at a fire sale price than to put in the effort required to get the network back on a path of positive growth, AOL ends with a net loss of $840 million or more for the social experiment. {TechCrunch} Neither company is confirming the final sale price, but reports range from $2.5 to less than 5 million {peHub} with the highest estimate coming in around $10 million. {TechCrunch}

And you thought Gilt’s sale prices were good.