The Wider Repercussions of an American Apparel Bankruptcy

American Apparel’s losses continue to grow, and sales continue to decline. Founder and CEO Dov Charney is being sued for sexual harassment by several former employees. Lion Capital, the financial backer that has continued to support American Apparel financially through years of losses and declines, left the board of the company.

While the LA Times reports Charney as saying the possibility of the company filing for bankruptcy protection were “not even a 1-in-1,000 chance,” many observers are wondering how much more the company can take before being forced to do so. Charney recently put his own money into the company, purchasing 6 million shares. There are 79 million shares of American Apparel available, and the purchase brought Charney’s portion up from 41 million to 44 million. The remaining 3 million won’t be released until the share price hits $3.50. {Styleite}

American Apparel stock is currently trading at $0.90 per share.

American Express has threatened to de-list American Apparel numerous times, so one option might be for Charney to take the company private, and that choice may be made for him. Even if the company is removed from public exchanges, that may not be enough to prevent the company from having to go into bankruptcy. Though the $250 million sexual harassment suit filed by Irene Morales looks like it may end up being resolved through binding arbitration, the mounting allegations will cost money to defend. Throw in the rising cost of cotton and natural fiber textiles with years of declining sales, and it’s difficult to see a way for the company to continue as a going concern.

Those who don’t care for Dov Charney, or the sexually charged company culture, may not view that as a problem, but there are aspects of the American Apparel model that would leave a significant void.

Living Wages

When asked on the Today Show why she would continue working with a boss who allegedly forced her into sexually abusive acts, Morales says “I’d gone out and looked for other jobs, but nothing was as good paying… the wages of American Apparel were pretty decent.”

When asked on the Today Show why she would continue working with a boss who allegedly forced her into sexually abusive acts, Morales says “I’d gone out and looked for other jobs, but nothing was as good paying… the wages of American Apparel were pretty decent.”

Most people would not consider enduring a hostile work environment a fair trade for retail wages – even “decent” ones, but one thing that can’t be ignored is American Apparel’s policy of paying above average wages to employees from the factory level to the retail floor. $12/hour versus $8/hour may not seem like an enormous amount, but for an employee who works 40 hours a week on an annual basis it’s a $7,680 difference. Larger stores with more stable sales and profits almost uniformly stick to the minimum, and keep that $7,600 for themselves.

With their very public financial troubles, few retailers are looking to American Apparel for guidance on matters like the wages paid to employees. A bankruptcy would likely see underperforming stores shuttered, and possibly well-performing stores also. In those markets, that takes away one of the few options a retail employee has for earning more than minimum wage.

American Manufacturing

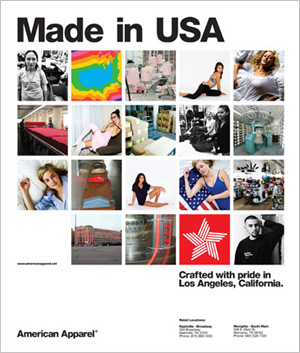

Made in USA ad, courtesy of American Apparel

The company has pinned part of their problems on an immigration inspection that forced them to layoff manufacturing workers who had discrepancies in work records, or appeared to not be eligible for legal employment in the US. When we spoke with Charney last year, he told us that in business terms that meant not being able to respond to trends and changes as quickly, presumably because many of those who were laid off were more skilled garment workers.

Though they came under investigation, there have been no findings of wrongdoing by US Immigration. Charney is outspoken in his support of a path to legalization for undocumented workers who’ve been working and paying taxes in the US. Whether you agree or disagree with his stance, the larger point is that American Apparel is one of the few clothing companies that provides American manufacturing jobs – at above average wages, as well.

In a time where very few American designers and brands at any end of the price spectrum actually make their garments in the United States, losing American Apparel would mean losing one of the few fashion companies that creates American jobs at every end of the supply chain.

Diverse Models

Forget the strange illustrations that don’t include any clothes (or models). Long before it became fashionable as a way to tap into the growing Asian market, American Apparel ads were one of the few places where seeing an Asian face was fairly common. Hispanic models are also featured regularly in ads and on the website, and though there is a noticeable dearth of Black models, you can generally find more diversity in a single American Apparel campaign than an entire issue of some major magazines.

It’s not just diversity in ethnicity; browsing the American Apparel site you’ll find models who appear a bit shorter than the typical model, not as thin, and seemingly not photoshopped into an unrecognizable state.

American Apparel’s claims that all models are actual employees has been challenged before, but even if the people you see are hired specifically to model for the company, they represent a somewhat more unvarnished view of what it means to be sexy or stylish.

That in no way makes it acceptable for those women to be subjected to harassment or unwanted sexual advances in exchange for their turn in front of the camera. As well documented as the complaints against Charney are, however, he is certainly not the first man in fashion to repeatedly come under scrutiny for pressuring models into sexually charged situations. Equal opportunity does not grant any free passes for perversion, but at a time when the calls for more diversity in advertising (and let’s be honest, runway shows are largely advertising at this point) are growing louder, losing American Apparel would mean losing one of the few companies that seems to be listening. Even if it’s in a tone-deaf way.