Zara Will Launch Limited Online Retail This Fall – We’re Not Impressed

We recently told you about the struggle fashion boutiques often face to open online retail stores given their limited resources and the often daunting challenge of attracting customers in the overwhelming online market. Apparently, opening an e-commerce shop can be difficult for larger, mass-market fashion stores as well.

Spanish fashion retailer Zara, though much too massive to be considered a boutique, has finally emerged from the ranks of shops with no online presence, with their e-commerce store set to officially launch September 2 in select countries. Inditex, Zara’s parent company, made the announcement after a successful financial run in the first quarter of 2010, with sales up 14 percent from last year. Shoppers in France, Germany, Italy, Portugal, Spain and the United Kingdom will be able to buy products from Zara online, but as of now there is no word on if and when Zara will have an online store available to customers in the U.S. {Fashionista}

Zara cited sourcing and logistics for their lack of online presence until now. The fashion retailer also reported that their clothes sell quickly, making it difficult to offer them online.

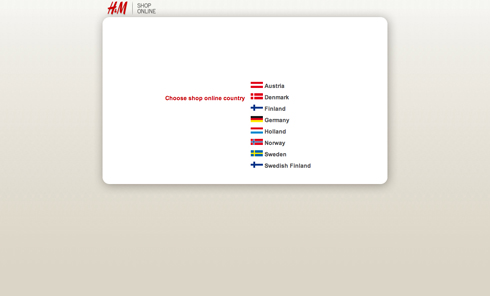

The company is not alone in its delayed entry into cyber shopping. Mass market retail giant H&M also has a limited online presence, with no online shopping offered to U.S. customers.

“I think the core thing with the fast fashion guys has been their inability to localize product by specific region,†Retail Analyst Brian Sozzi told Fashionista. “The way I think about H&M, Zara, Forever 21 is that they make a broad bet on fashion, allowing them to receive good costs.†He also said large retailers have focused the majority of their energy on growing their physical stores rather than their Web presence.

Here’s the thing: when the economy was at it’s worst, online retail sales were the one area that either grew or didn’t suffer as much from the downturn. Not having an e-commerce operation at this point is inexcusable for a global retailer. Not only are they missing out on shoppers who may not be near a physical location, but the wait and see approach to e-commerce makes these companies seem like dinosaurs. Offline retail is enormous, but slow and cumbersome. If a retailer wants to know how a certain product will perform in a certain market, it can take weeks to test and respond. Online, a retailer can have thousands of purchases that indicate trends within days. Retailers, particularly mass retailers who target fast fashion shoppers, who fail to put the same level of effort into e-commerce as they do into offline retail risk suffering the same fate as the dinosaurs.

This also ignores incredibly successful online only operations: Net-a-Porter was sold to luxury conglomerate Richemont in a deal that valued the company at £350 million in March (approximately$531 million at the time), Yoox had an IPO in December of 2009 and the company has a current market cap of €284 (approximately $340 million at the current exchange rate). While that may not be enough to replace an offline presence – H&M’S market cap is $21 billion, one e-commerce store worth half a billion dollars could easily keep pace with or outperform even the busiest flagship location.

Then there are the offline behemoths who have similarly fast moving merchandise – Forever 21, for one has managed to build a successful online operation alongside their many physical locations. If they can figure it out, what’s taking Zara, H&M and others so long?

The difficulty in creating a successful online retail store is understandable; but particularly in a tough economy where people are online everyday but not going to malls and shopping districts as often (if at all), Zara and others like it must continue to focus on their Web presence in order to remain relevant into the future.